When it comes to taxes, the differences between corporate tax and personal tax can have a huge impact on your financial strategy and bottom line. Whether you're a business owner contemplating your entity structure or an individual seeking to optimize your tax situation, having a clear understanding of how corporate income tax and personal income tax work is essential to inform your tax planning decisions. The Lewis.cpa team is here to guide you through this topic to help you optimize your strategy.

The Core Difference: How Corporate and Personal Taxes Work

The tax system treats individuals and corporations differently, creating distinct advantages and challenges for each structure.

Personal taxes use seven marginal tax rates that increase with income, while corporations pay a flat 21% rate regardless of profit level. Corporate profits face potential double taxation when distributed as dividends, while individual income is taxed only once. According to the SBA, small businesses represent 99.9% of all U.S. businesses, with business structure decisions potentially resulting in effective tax rate differences of 10-15 percentage points.

The Structure of Personal Income Tax Rates

Personal income tax rates for 2025 include seven tax brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. These rates increase progressively, meaning higher earners pay higher rates on income above certain thresholds. For example, single filers reach the top 37% rate on income exceeding $626,350, while married couples filing jointly hit this rate at $751,600.

What does your personal income include? Wages, salaries, tips, business income from sole proprietorships, investment income, and other sources. After calculating your gross income, you can reduce your taxable income through deductions and tax credits, ultimately determining how much you owe in federal income tax.

Corporate Tax Structure: The 21% Flat Rate Reality

Since the Tax Cuts and Jobs Act took effect, corporations pay a flat corporate tax rate of 21% on their net income. This rate applies to C corporations — traditional corporations that are separate legal entities from their owners. The corporate income tax is calculated on the company's income after deducting legitimate business expenses, depreciation, and other allowable costs.

This flat rate structure means that whether a corporation earns $100,000 or $100 million in profit, the tax rate remains constant at 21%. However, the effective tax rate can vary depending on available tax credits and deductions that can reduce the overall tax burden.

Business Entity Types and Their Tax Implications

The type of business entity you choose dramatically affects how you pay taxes. Let’s delve into these differences to help business owners make optimal structural decisions.

C Corporations and Double Taxation

C corporations face what's known as double taxation. First, the corporation pays corporate income tax on its profits at the 21% rate. Then, when these profits are distributed to shareholders as dividends, shareholders pay personal income tax on those dividends. This same dollar gets taxed twice — once at the corporate level and again at the individual level.

Pass-Through Entities: Avoiding Double Taxation

Pass-through entities, including sole proprietorships, partnerships, S corporations, and most LLCs, avoid this double taxation problem. Instead of the business paying corporate income tax, all income, deductions, and credits "pass through" to the owners' personal tax returns. The business itself typically doesn't pay federal income tax. Instead, the owners report their share of business income on their individual tax returns and pay personal income tax rates on that income.

For pass-through entities, owners may benefit from the Section 199A deduction, which allows them to deduct up to 20% of qualified business income. This can effectively reduce their tax rate on business income. This deduction begins phasing out for high earners and has specific limitations for certain professional services.

Self-Employment Tax Considerations

Business owners in pass-through entities often face self-employment tax, which covers Social Security and Medicare taxes. This tax applies to net profit from self-employment, and the business owner pays it directly. The self-employment tax rate includes both the employer and employee portions of these payroll taxes, totaling 15.3% on the first $168,600 of income for Social Security (for 2025) plus 2.9% for Medicare taxes on all income.

Filing Requirements and Deadlines

The filing process differs significantly between personal and business tax returns. Individual taxpayers typically file Form 1040 by April 15 each year, though extensions can push this deadline to October 15. Personal tax returns report all sources of income, deductions, and credits to calculate the final tax liability.

Business tax return requirements vary by entity type. For example, C corporations file Form 1120, while partnerships use Form 1065. S corporations file Form 1120S. Many businesses must also make quarterly estimated tax payments throughout the tax year rather than paying once annually, like most individual taxpayers.

Small Businesses and Tax Planning Strategies

Small businesses have unique opportunities for tax planning that can significantly impact their tax burden. The choice between operating as a sole proprietorship, partnership, LLC, S corporation, or C corporation affects not only current-year taxes but also long-term tax planning strategies.

Many small businesses choose pass-through structures to avoid double taxation and benefit from the 199A deduction. The IRS reports that eligible taxpayers can deduct up to 20% of qualified business income through this provision. However, as businesses grow and retain earnings for expansion, converting to C corporation status can offer tax advantages, particularly if the business can benefit from the flat 21% corporate rate compared to higher personal income tax rates.

Payroll Taxes and Employment Considerations

Payroll taxes add another layer of complexity to the corporate tax vs. personal tax discussion. Employers must withhold and pay several types of payroll taxes, including:

- Federal income tax withholding from employee wages.

- Social Security taxes (6.2% each for employer and employee).

- Medicare taxes (1.45% each for employer and employee).

- Federal and state unemployment taxes.

These payroll taxes are separate from corporate income tax and are a significant cost for businesses with employees. The employer portion of payroll taxes is deductible as a business expense, reducing the company's taxable income.

Capital Gains Treatment Differences

How capital gains are treated varies significantly between corporations and individuals. Individual taxpayers benefit from preferential capital gains tax rates — 0%, 15%, or 20% depending on the income level — or assets held longer than one year. Short-term capital gains are taxed at ordinary personal income tax rates.

For corporations, capital gains are taxed at the same rate as ordinary business income, which is the flat 21% corporate tax rate. This eliminates the preferential treatment that individuals receive on long-term capital gains, so the corporate structure is potentially less advantageous for investment activities.

State and Local Tax Considerations

While federal tax rules provide the framework, state and local taxes add complexity to the corporate tax vs personal tax analysis. Most states impose their own corporate income tax, with rates ranging from 2.25% in North Carolina to 11.5% in New Jersey. Some states, like South Dakota and Wyoming, don't impose corporate income tax at all.

State personal income tax rates also vary widely; some states have no personal income tax, while others impose rates exceeding 13%. The interaction between federal and state tax systems can have a huge impact on the overall tax burden for both individuals and corporations.

International Tax Implications

The corporate tax structure offers different advantages than personal taxation for international businesses. The Tax Cuts and Jobs Act moved the U.S. toward a territorial tax system for corporations, generally exempting foreign-sourced income from U.S. taxation (with some exceptions and anti-avoidance rules).

Individual taxpayers with foreign income may face different rules, including the foreign earned income exclusion and foreign tax credits. However, the corporate structure may provide more favorable treatment for international operations, depending on the specific circumstances. If you’re in this position and you need guidance, our team at Lewis.cpa can help.

Tax Credits and Deductions: Corporate vs. Personal

Both corporations and individuals can benefit from various tax credits and deductions, but keep in mind that the available options differ significantly. Corporations can deduct ordinary business expenses, including salaries, rent, equipment costs, professional services, and other business costs. They can also claim business-specific credits like the research and development credit.

Individual taxpayers can choose between itemizing deductions or taking the standard deduction ($15,000 for single filers and $30,000 for married couples filing jointly in 2025). Personal tax credits include the child tax credit, earned income tax credit, education credits, and others designed to provide relief for specific circumstances.

When to Consider Changing Your Tax Structure

Several factors could prompt you to reconsider your tax structure:

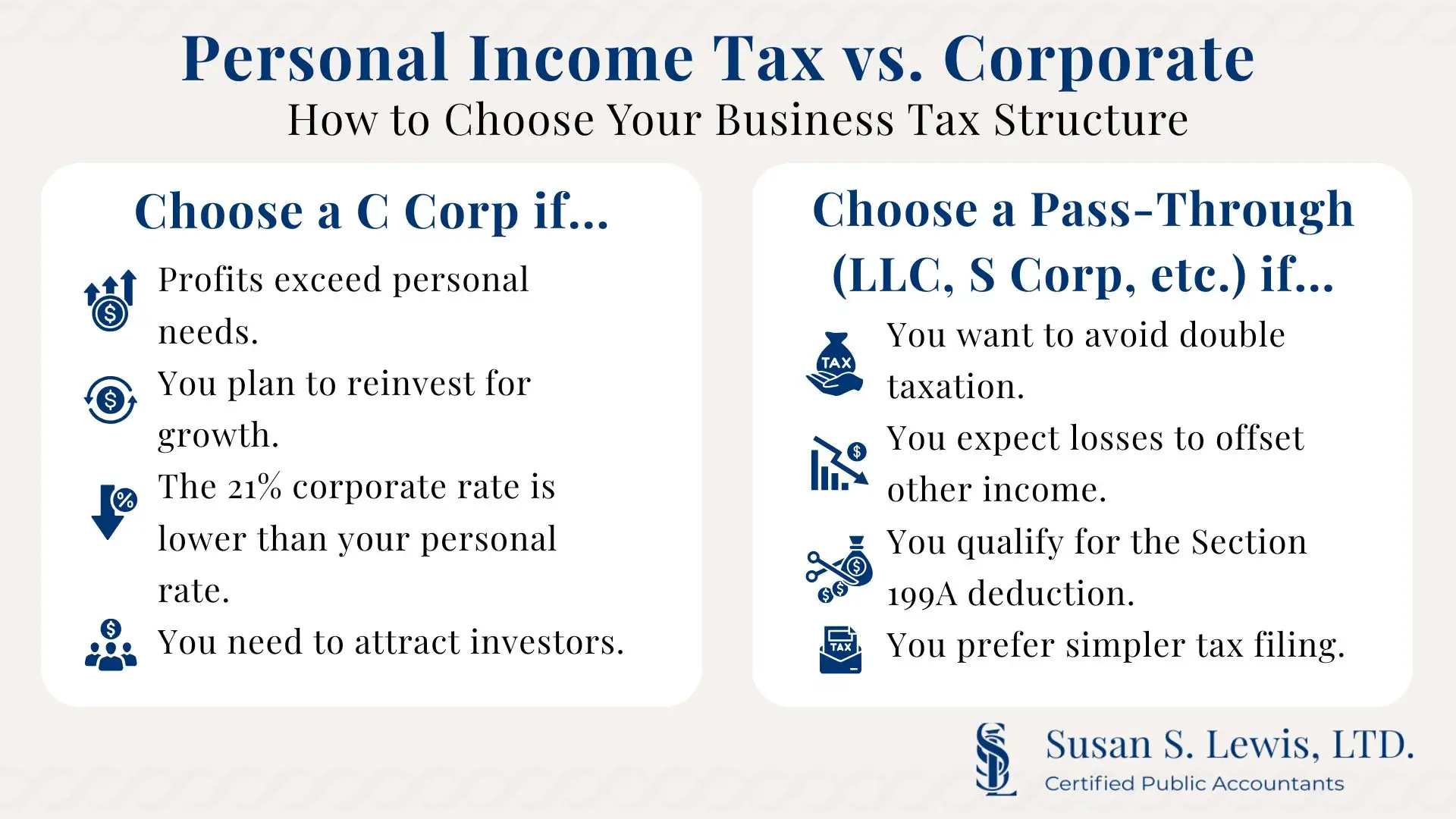

Consider corporate structure when:

- Business profits consistently exceed what you need for personal expenses.

- You want to retain earnings in the business for growth.

- The 21% corporate rate is lower than your personal marginal tax rate.

- You need to attract investors or go public.

Consider a pass-through structure when:

- You want to avoid double taxation.

- Business losses can offset other income.

- You qualify for substantial Section 199A deductions.

- You prefer simpler tax filing requirements.

The Impact of Recent Tax Law Changes

The Tax Cuts and Jobs Act brought significant changes to both corporate and personal taxation. The reduction in corporate tax rates from 35% to 21% made corporate structures more attractive for some businesses. However, many individual provisions are scheduled to expire after 2025, which will potentially change the analysis again.

Recent legislation, like the One Big Beautiful Bill Act of 2025, has made some business provisions permanent while leaving uncertainty around individual tax rates. Optimal tax planning revolves around staying informed about legislative changes.

Making the Right Choice: Expert Tax Guidance

The complexity of tax law and the significant financial impact of entity selection make professional tax guidance invaluable. At Lewis.cpa, our seasoned team with decades of experience will help you choose the right tax structure depending on your specific circumstances, including income levels, business goals, liability concerns, and long-term objectives. Contact us today to discuss your tax strategy and ensure you're maximizing your tax efficiency while remaining compliant with current tax laws.